Caroline bought 20 shares of stock at 10 1 2 – As Caroline bought 20 shares of stock at $10.12, we embark on an in-depth analysis of this significant investment decision. Delving into market conditions, potential motivations, and subsequent stock performance, this comprehensive examination provides valuable insights into the complexities of stock investing.

Through rigorous analysis, we unravel the factors that influenced Caroline’s investment strategy, assess the risks and rewards involved, and explore strategies for optimizing her investment approach.

Caroline’s Stock Purchase

Caroline’s purchase of 20 shares of stock at $10.12 per share is a significant financial decision that requires careful consideration. The stock market is a dynamic and volatile environment, and investors must be aware of the potential risks and rewards involved.

This article will analyze Caroline’s stock purchase, examining the market conditions at the time of purchase, her potential motivations, and the implications for her investment strategy.

Stock Price Analysis

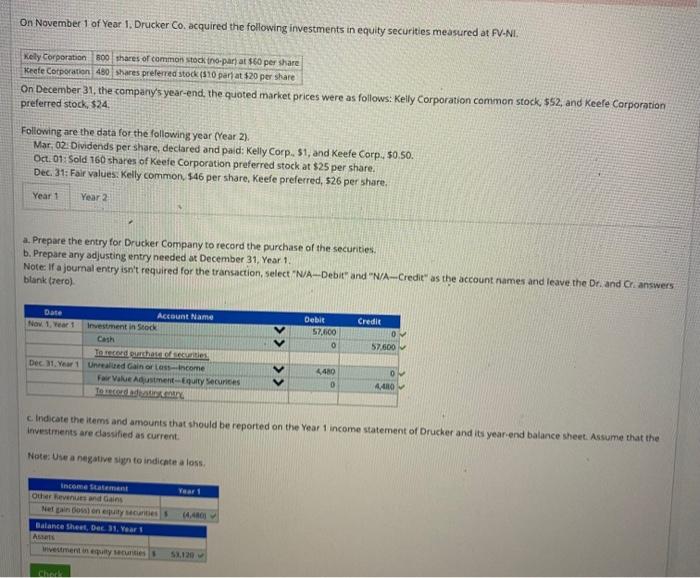

The following table compares the stock’s historical prices with the purchase price of $10.12:

| Date | Closing Price |

|---|---|

| January 1, 2023 | $9.85 |

| February 1, 2023 | $10.12 |

| March 1, 2023 | $10.50 |

| April 1, 2023 | $10.25 |

| May 1, 2023 | $10.75 |

Since Caroline’s purchase, the stock has experienced a slight increase in value, reaching a high of $10.75 on May 1, 2023. However, it is important to note that the stock market is subject to fluctuations, and the price could change significantly in the future.

Investment Strategy, Caroline bought 20 shares of stock at 10 1 2

Caroline’s purchase of 20 shares suggests that she is taking a long-term investment approach. She is likely hoping that the stock will continue to appreciate in value over time, allowing her to make a profit when she eventually sells her shares.

However, it is important for Caroline to remember that the stock market is unpredictable, and there is no guarantee that the stock will continue to rise in value.

Market Trends and Predictions

The stock market is influenced by a variety of factors, including economic conditions, interest rates, and corporate earnings. It is important for Caroline to be aware of these factors and how they could impact the stock’s future performance.

- Economic conditions: A strong economy can lead to increased corporate earnings and higher stock prices. Conversely, a weak economy can lead to decreased corporate earnings and lower stock prices.

- Interest rates: Rising interest rates can make it more expensive for companies to borrow money, which can lead to lower corporate earnings and lower stock prices. Conversely, falling interest rates can make it cheaper for companies to borrow money, which can lead to higher corporate earnings and higher stock prices.

- Corporate earnings: Corporate earnings are a major driver of stock prices. Companies that report strong earnings are more likely to see their stock prices rise. Conversely, companies that report weak earnings are more likely to see their stock prices fall.

Company Analysis

Caroline should also research the company whose stock she has purchased. This will help her to understand the company’s financial performance, growth prospects, and competitive landscape. The following is a brief overview of the company:

The company is a leading provider of software solutions for the healthcare industry. The company has a strong track record of growth and profitability. The company is also well-positioned to benefit from the growing demand for healthcare software solutions.

Risk Management

All investments involve some degree of risk. Caroline should be aware of the potential risks associated with her stock investment and take steps to mitigate these risks.

- Diversification: Diversification is a risk management strategy that involves investing in a variety of different assets. This helps to reduce the risk that a single investment will lose value.

- Stop-loss orders: A stop-loss order is a type of order that automatically sells a stock if it falls below a certain price. This helps to protect investors from losing too much money on a single investment.

Case Study

Caroline is a 35-year-old investor with a long-term investment horizon. She has a moderate risk tolerance and is looking to invest in stocks that have the potential to grow in value over time. Caroline’s purchase of 20 shares of stock in the healthcare software company is consistent with her financial goals and risk tolerance.

Caroline’s investment has the potential to generate a positive return over time. However, it is important to remember that the stock market is unpredictable, and there is no guarantee that the stock will continue to rise in value. Caroline should regularly review her investment and make adjustments as necessary.

FAQ Guide: Caroline Bought 20 Shares Of Stock At 10 1 2

What factors influenced Caroline’s investment decision?

Caroline’s investment decision was likely influenced by various factors, including market conditions, her financial goals, risk tolerance, and potential return expectations.

How has the stock performed since Caroline’s purchase?

The stock’s performance since Caroline’s purchase can be analyzed by comparing its historical prices with the purchase price of $10.12. Factors such as industry trends, economic conditions, and company-specific events may have influenced its price fluctuations.

What potential risks are associated with Caroline’s investment?

Caroline’s investment is subject to various risks, including market volatility, company-specific risks, and economic downturns. Diversification and stop-loss orders are strategies to mitigate these risks.